Managing your Account Balance

The Balance page is your single source of truth for all financial transactions related to your incentive programs. This powerful tool gives you full transparency over your account activity, including global and program-specific balances, with advanced filtering capabilities designed to streamline your internal reconciliation processes.

Step-by-Step Guide

Navigating and Understanding Your Balances

- Navigate to the Finance section under Account in the left-hand navigation bar.

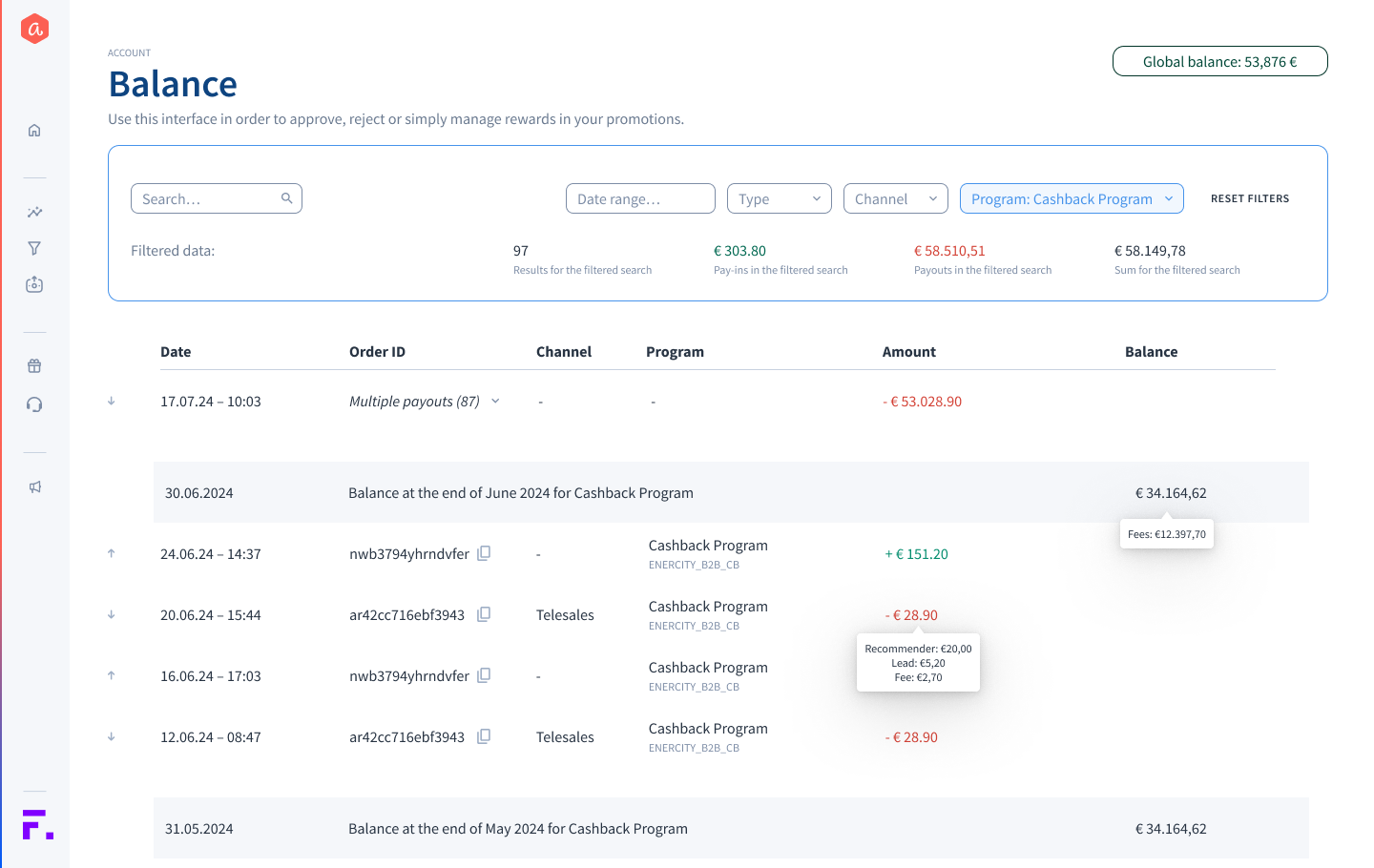

- Review the Global Balance. The Global Balance displayed in the top right corner represents the current total balance across all programs in your account.

- Check Monthly Summaries. Scroll through the main transaction table. You will see clear, bolded rows that automatically summarize the Balance at the end of Month for the current set of applied filters, providing easy month-end reconciliation points.

- View Transaction Details. Each row represents a single transaction. Hover over the Amount column to view a detailed breakdown of the value, including the Recommender reward, Lead reward, and Fee applied to that specific transaction.

- Quickly Copy IDs. For fast look-ups, simply click the copy icon next to any Order ID to copy the unique identifier for use in the Reward Management Search or external systems.

Using Advanced Filters for Reconciliation

The filtering panel allows you to quickly segment transactions to match your specific internal reporting needs.

- Filter by Program. Click the Program dropdown to select one or more specific incentive programs you wish to review.

- Filter by Channel. Use the Channel dropdown to filter transactions by their Sales Channel (e.g., Online, In-store, Tele-sales)

- Note: This feature is critical for teams reconciling payments based on the channel that provided the budget.

- Filter by Date Range. Click Date Range to select predefined periods (like a month or quarter) or define a custom period to perfectly align the data with your internal accounting cycles.

- Filter by Type. Use the Type dropdown to isolate specific types of financial movements:

- Pay-ins: Funds deposited into your Aklamio account.

- Rewards: Funds paid out for rewards and fees.

- Refunds: Funds refunded from you Aklamio account to your company bank accounts.

- Review the Filtered Data Summary. Immediately above the transaction table, a summary panel dynamically updates to show:

- The total number of results found.

- The total Pay-ins for the filtered data.

- The total Pay-outs for the filtered data.

- The overall resulting Balance for the transactions currently displayed in the table. If you filter by just the Program this will represent the actual balance of a specific Program.

💡 Best Practices

- Channel Reconciliation: If your organization tracks budget and performance by sales channel (e.g., separate budgets for online vs. call center referrals), ensure you assign a Channel to your Pay-in transactions. This allows you to use the Channel filter to view the balance exclusively for that segment, simplifying budget reconciliation.

- Connecting Financials to Rewards: If you are using the ID search or copy function to investigate a specific reward transaction, navigate to Operate > Reward Management and use the same ID in the search bar to find the full reward validation history.

🔧 Troubleshooting

- Why can't I see a balance for a specific Channel?

If you filter by a specific channel, the system can only calculate a true balance if the corresponding Pay-in (budget deposit) was also tagged with that same channel. If channels are not assigned to your pay-ins, the channel filter will primarily reflect pay-outs (rewards and fees) and may not show a fully reconciled balance.